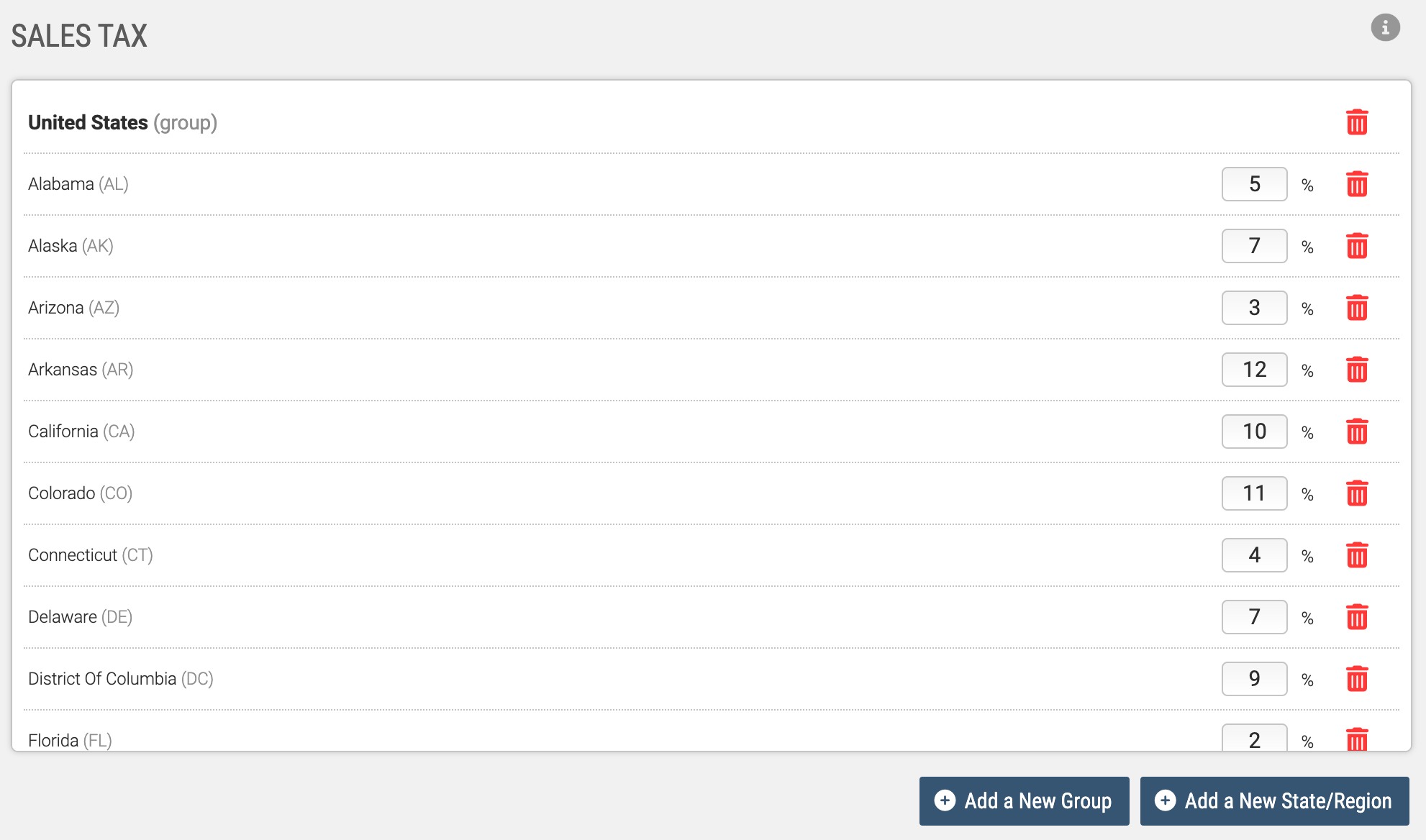

Manage Sales Tax Settings

Here is where you can set up sales tax rates.

Worth a special mention here is also how the data here flows into the LMS. When you set up tax rates, you first set up Groups (example: United States), and then add States and/or Regions into that group. The structure of the groups and states and regions are what will appear on the State dropdown box for all user profile edit screens.

The way this form works is, once you add the groups, states and/or regions, you will be able to assign a tax rate for each one. When a purchaser fills out their billing information, the tax rate used will be that of the State their billing address is located.

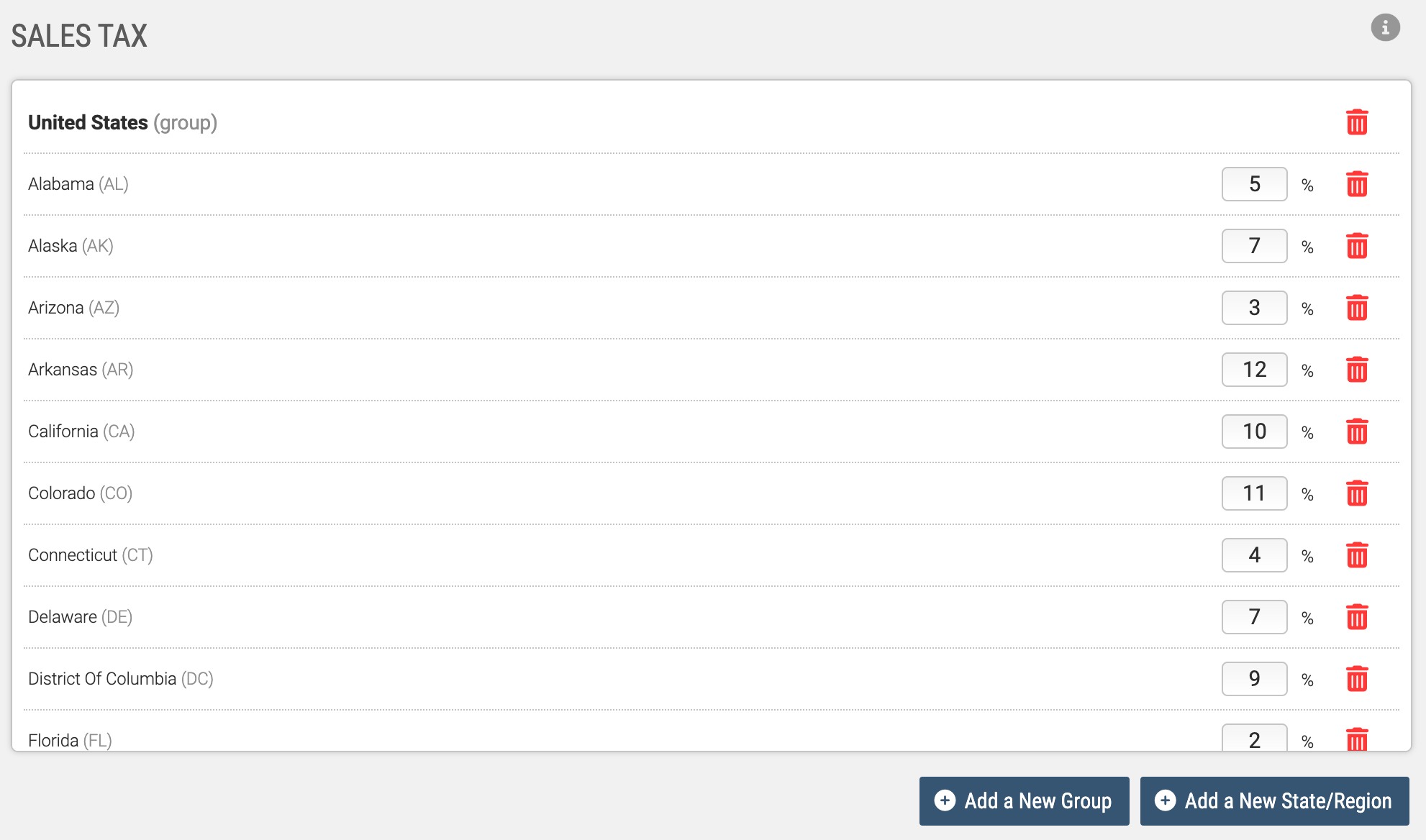

Here is where you can set up sales tax rates.

Worth a special mention here is also how the data here flows into the LMS. When you set up tax rates, you first set up Groups (example: United States), and then add States and/or Regions into that group. The structure of the groups and states and regions are what will appear on the State dropdown box for all user profile edit screens.

The way this form works is, once you add the groups, states and/or regions, you will be able to assign a tax rate for each one. When a purchaser fills out their billing information, the tax rate used will be that of the State their billing address is located.