Digital transformation has reshaped nearly every sector, and banking is no exception. In 2026, as digital banking continues its meteoric rise, customer education for digital banking has become not just beneficial, but essential.

From managing mobile transactions to understanding cybersecurity best practices, informed users are the foundation of secure and successful digital banking ecosystems. As digital platforms evolve in complexity, customers must be equipped with the knowledge to use these systems effectively, safely, and confidently.

The Digital Banking Revolution

Over the past decade, digital banking has transitioned from a convenient alternative to a dominant financial services model. Today, consumers expect mobile-first experiences, instant payment systems, AI-powered support, and intuitive apps for every aspect of their financial lives. With neobanks, fintech startups, and even traditional banks competing in the digital space, users are navigating more platforms and services than ever.

However, the speed at which digital banking evolves can leave customers behind—especially those unfamiliar with new technologies. This is where customer education for digital banking becomes critically important.

Why Customer Education for Digital Banking Is a Strategic Imperative

Enhancing Customer Confidence and Adoption

Even the most intuitive banking platforms require guidance. Customer education for digital banking ensures users understand app features, increasing confidence and digital adoption. Through tutorials, onboarding, and in-app support, banks empower users to explore tools like payments, budgeting, or mobile deposits. Informed customers are more engaged, less dependent on support, and more likely to adopt advanced features—ultimately strengthening loyalty and overall satisfaction in digital banking environments.

Minimizing Security Risks Through Education

Digital banking threats in 2026 (like phishing, malware, and deepfakes) demand a proactive approach. Customer education for digital banking teaches users to spot scams, secure accounts, and practice good cybersecurity. From fraud awareness to multi-factor authentication, educated users serve as the first line of defense. Institutions that invest in ongoing education reduce risk exposure, build customer trust, and create safer banking experiences for everyone across their digital platforms.

Reducing Support Costs

Common customer issues, like login errors or navigation confusion, are preventable through proper training. By implementing training platforms for customer education, banks provide self-service tools like FAQs, video guides, and walkthroughs. Educated customers solve problems independently, decreasing call center volume and operational costs. Support teams can then focus on complex cases. This not only improves efficiency and reduces expenses but also leads to a better customer experience and satisfaction.

Meeting Regulatory Expectations

With stricter regulations around privacy, disclosures, and financial literacy, banks must ensure compliance. Customer education for digital banking helps customers understand terms, policies, and responsibilities, lowering the risk of misuse or noncompliance. Education programs aligned with regulations empower users while protecting institutions legally. By promoting transparency and responsible digital behavior, banks avoid fines and build stronger trust among customers in today’s data-sensitive financial landscape.

Key Components of Effective Customer Education in 2026

Personalized Learning Paths

Modern customer education is no longer a one-size-fits-all approach. Training platforms must adapt to users’ financial literacy, device preferences, and learning styles. AI-driven Training Platform for Customer Education solutions now offer tailored learning experiences that increase retention and engagement.

Microlearning and Mobile Accessibility

Given the fast-paced nature of modern life, microlearning—delivering content in bite-sized, focused modules—is ideal for digital banking users. Coupled with mobile-first delivery, customers can learn on their own time, directly within the banking app interface.

Gamification and Interactive Design

Gamification features such as quizzes, achievements, and real-time feedback not only make learning more engaging but also improve comprehension. Corporate LMS systems increasingly integrate these elements to make training modules more impactful, especially for younger, digital-native users.

Real-Time Contextual Help

In-app prompts, FAQs, and real-time chatbots guide customers through processes such as setting up two-factor authentication, disputing transactions, or applying for loans. Integrating customer education into the user journey eliminates friction and encourages independence.

The Role of Learning Management Systems (LMS)

Using LMS for Scalable Customer Education

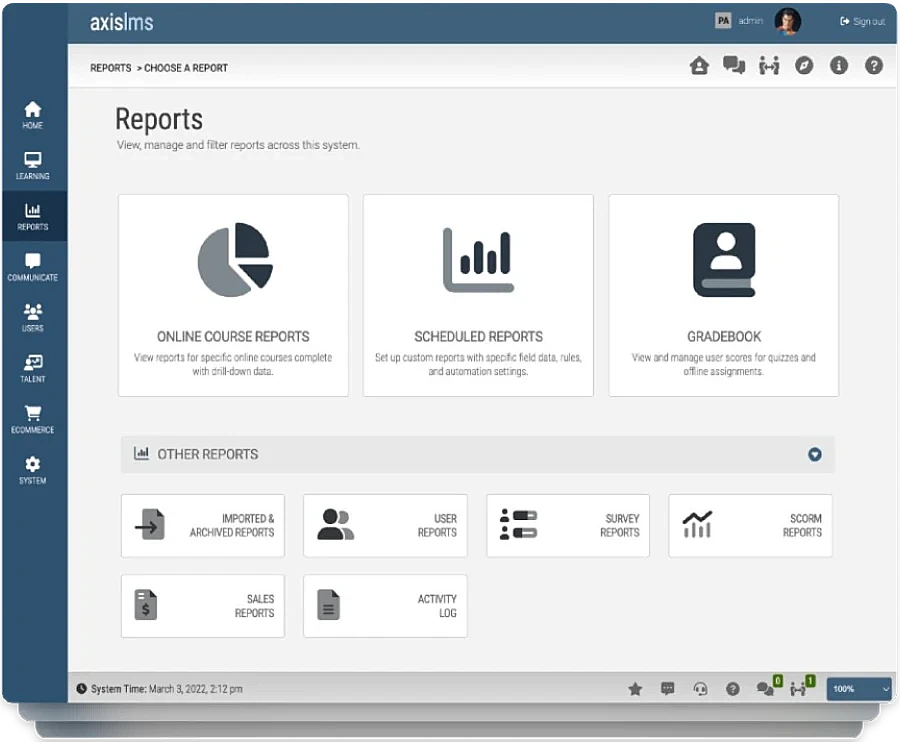

While originally designed for internal corporate training, LMS platforms are now being adapted for external education use cases. A well-configured Training Platform for Customer Education allows banks to deploy, manage, and track the effectiveness of learning modules at scale.

Advantages of LMS for Small Companies

For regional banks or fintech startups, an LMS for small companies offers a cost-effective way to compete with larger institutions. These LMS platforms provide customizable, modular training experiences that help small players meet growing customer expectations without massive resource investments.

Integration with Existing Digital Infrastructure

LMS systems can be seamlessly integrated with mobile apps, CRM platforms, and data analytics tools. This enables real-time personalization, progress tracking, and insights that drive continual improvement in customer education.

Corporate LMS Systems in Customer Education

While traditionally used for employee training, corporate LMS systems now play a vital role in customer education for banks and fintech firms. These platforms help onboard users, explain product features, and support clients through digital transformation with consistent, structured content.

When customers open new accounts or use new features, LMS tools can deliver tutorials, interactive guides, and bite-sized lessons tailored to their needs. Whether it’s understanding mobile banking tools, enabling security features, or navigating investment products, LMS-driven education ensures clarity and confidence.

Corporate LMS systems also standardize messaging across platforms, reducing errors and maintaining compliance—critical in a tightly regulated industry. Real-time analytics allow institutions to track engagement, assess learning outcomes, and improve content over time.

By integrating customer-facing education into their LMS strategy, financial institutions boost adoption, reduce support costs, and foster trust—while ensuring customers remain informed, empowered, and secure in their digital banking journey.

Future Trends in Customer Education for Digital Banking

As digital banking evolves, so too does the way institutions educate and empower their users. In 2026 and beyond, customer education is becoming more intelligent, interactive, and decentralized. Here’s a closer look at the key trends shaping the future of customer education for digital banking:

AI-Driven Personalization

Artificial intelligence is revolutionizing the way banks deliver educational content. AI algorithms can now monitor user behavior—such as which app features are used most, common support queries, or time spent in different sections—to tailor learning experiences in real time.

For example, if a user frequently accesses payment features but ignores budgeting tools, the system can prompt microlearning modules about financial planning or personalized tutorials to increase adoption. These intelligent suggestions improve learning efficiency and reduce customer frustration. AI also enables dynamic testing and skill assessments, adjusting difficulty based on performance to optimize knowledge retention.

Voice and Conversational Interfaces

As voice technology matures, customer education is moving beyond screens. Smart assistants and conversational interfaces (like chatbots integrated with banking apps or IVR systems) are being used to deliver on-demand guidance.

Customers can now ask questions like “How do I activate my debit card?” or “What is a fixed deposit?” and receive accurate, conversational answers in real time. Voice-enabled support also plays a crucial role in financial accessibility, especially for visually impaired users or those with low digital literacy. This trend promotes a more inclusive and intuitive learning experience.

Blockchain-Based Credentialing

Blockchain technology is introducing a new level of transparency and trust in customer education. As users complete training modules on digital banking security, compliance, or product usage, they can receive blockchain-secured certificates as proof of completion.

These credentials can be particularly useful in Know Your Customer (KYC) processes, financial planning, and regulatory audits—demonstrating that the customer has been adequately informed. It also offers a tamper-proof way to verify user engagement and learning outcomes, fostering trust between the institution and the customer.

Community-Driven Learning

Peer-to-peer learning is emerging as a powerful complement to institutional education. Banks and fintech firms are building digital forums, community hubs, and social learning spaces where users can share knowledge, ask questions, and discuss best practices.

These communities not only help resolve issues quickly but also create a sense of connection among users. Some platforms even incentivize participation—offering loyalty points, badges, or rewards for users who contribute helpful advice or complete learning challenges. This gamified, social approach enhances engagement and encourages continuous learning beyond formal tutorials.

Measuring the Impact of Customer Education

For financial institutions to justify continued investment in customer education initiatives—and to optimize them over time—they must rely on clear, measurable outcomes. Here are the four essential categories institutions should monitor:

Engagement Metrics:

One of the first indicators of successful customer education is engagement. Metrics such as course completion rates, time spent per learning module, and the frequency of return visits help assess how effectively content captures user attention. For instance, high completion rates indicate that users find the content relevant and digestible, while frequent return visits suggest ongoing value.

Low engagement, on the other hand, may signal that content is too long, complex, or not aligned with user needs. By analyzing these patterns, banks can adjust the format, duration, and placement of their educational materials to maximize interaction and knowledge retention.

Behavioral Changes:

Engagement is only the starting point; the real test is whether education translates into meaningful action. Behavioral metrics look at how learning influences customer activity—such as an increase in digital product usage or a decrease in support inquiries.

For example, after completing a module on mobile check deposits, a noticeable uptick in usage of that feature would reflect successful knowledge transfer. Similarly, a reduction in basic customer support calls suggests that users are more self-sufficient and better equipped to handle tasks independently. These behavioral shifts help institutions gauge whether their education programs are not just informative but truly transformative.

Security Improvements:

In an era of escalating cyber threats, one of the most valuable outcomes of customer education is heightened security awareness. A well-informed customer is more likely to recognize phishing scams, adopt protective measures like multi-factor authentication, and report suspicious activity promptly.

Over time, this results in measurable reductions in fraud incidents and unauthorized access attempts. Additionally, educated customers are more cautious when sharing sensitive information or clicking unknown links. These behaviors enhance the bank’s overall cybersecurity posture and contribute to a more resilient digital ecosystem. Regular security-focused learning modules can ensure that this awareness is sustained and evolves alongside emerging threats.

Compliance Outcomes:

Financial institutions operate under strict regulatory oversight, and customer misunderstandings can lead to costly violations. Effective education can minimize this risk by ensuring customers clearly understand policies, disclosures, and legal requirements. When customers are better informed, they are less likely to make errors during KYC (Know Your Customer) processes, mishandle sensitive data, or misinterpret terms and conditions.

This leads to fewer disputes, stronger audit trails, and improved compliance during regulatory reviews. Additionally, documented completion of training—especially through corporate LMS systems—provides evidence that the institution has fulfilled its duty to educate and inform, which is critical for legal and reputational protection.

Challenges to Address

- Digital Divide: Rural or senior customers may still struggle with tech access or literacy.

- Language and Accessibility: Multilingual content and accessibility features are critical.

- Content Relevance: Outdated or generic content can disengage users.

Successful education strategies address these by designing inclusive, current, and diverse learning content.

Conclusion

In 2026, customer education for digital banking is a cornerstone of financial innovation and trust. By leveraging advanced training platforms for customer education, integrating with corporate LMS systems, and providing tailored content through LMS for small companies, institutions can create secure, empowered, and loyal customer bases. As digital banking continues to evolve, education remains the most strategic tool for shaping the future of finance.

FAQs

What is the role of customer education in digital banking?

Customer education in digital banking equips users with the knowledge to navigate online banking platforms safely and effectively. It enhances confidence, promotes adoption, and reduces security risks by ensuring users understand processes, policies, and digital tools.

Benefits of digital banking to customers?

Digital banking offers customers 24/7 access to services, faster transactions, reduced need for physical branches, real-time monitoring, and innovative financial tools. With proper education, users can fully leverage these advantages.

How do digital banks work?

Digital banks operate primarily online without physical branches. They use mobile apps and websites to provide services such as account management, fund transfers, payments, and loans. Their operations rely on automation, cloud infrastructure, and digital identity verification.

Why is digital banking important?

Digital banking is important because it provides accessibility, convenience, and efficiency for both consumers and financial institutions. It reduces operational costs and expands financial inclusion while enabling fast, user-friendly services globally.